Powerful Price Action EA

– 15 Activations

– Lifetime License

-Free future updates

-Support

-No martingale, no grid, no scalp, no dangerous strategies

$500.00 $399.00

You’ll receive personalized support from the developer throughout the entire process. If you have any questions, please don’t hesitate to reach out.

Telegram: https://t.me/BRobotTrader

Email: intelligentforexrobots@gmail.com

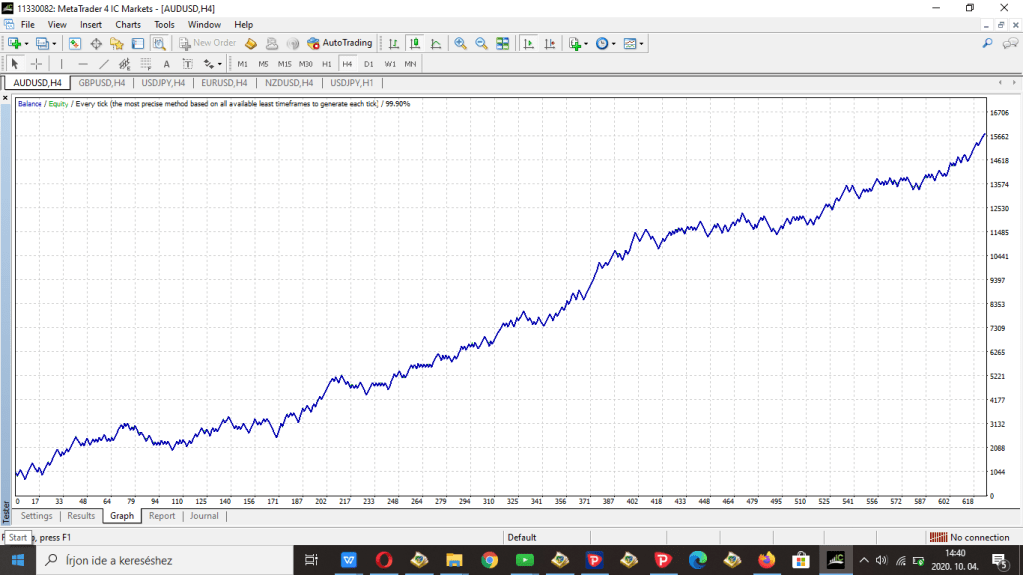

20 years 99.9% backtest with 1% risk per trade on EURUSD H4

Powerful Price Action EA Advanced Version with NomadTrader© Money Management System:

–Full EA with all adjustable settings and parameters to tweak or optimize.

–It uses the NomadTrader© Money Management system with Dynamic exit strategy based on Price %(percent) based Stop loss, Take Profit and Adjustable Time Filter to 1 minute preciseness, all parameters are precisely calculated to be in motion with the Core Strategy.

Details:

–Free updates

–20 years full professional test reports

–Tested for the last 20 years!

–Best on major and minor pairs, major metals.

–99.9% tick data test.

–minimum optimal desposit: 300$

If you have specific drawdown and profitability parameters that you’d like us to test in QuantAnalyzer, please inform us, and we’ll be glad to assist.

Download the official 20 years portfolio made with QuantAnalyzer: Starting deposit: 1000$, Mode: Very low risk. Prop Trading Compatible.

Download the official 20 years portfolio made with QuantAnalyzer: Starting deposit: 1000$, Mode: Medium risk.

Strategy: The strategy combines old school trend following methods with data analysis

based on key points, like correlation, risk:reward ratio, secret strategy with certain candle

patterns that was created by artificial intelligence, it combines Engulfing patterns and Doji candle, it is a completely new Price Action pattern that is not known by big banks, and hedge funds, the formula is entirely owned by our research team.

Risk:Reward is always minimum 1:1 ratio.

DOES NOT USE Dangerous systems like the Grid, martingale and other risky strategies.

Recommendations:

Risk recommendation 1000USD/0.1 lots for low risk secure trading.

use vps for if you can, even better trading experience.

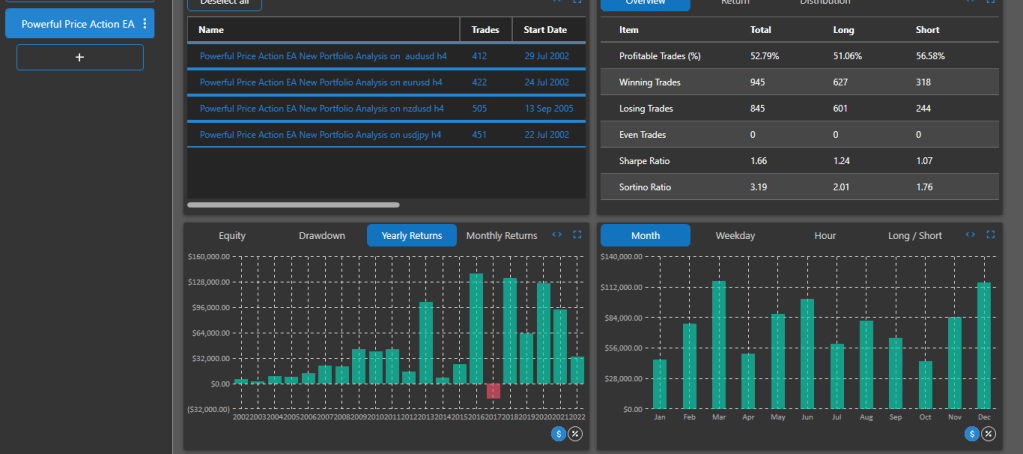

20 year portfolio analysis test with all the pairs combined:

Portfolio Analysis

Here’s why portfolio analysis is paramount:

- Real-world Application: Trading algorithms are designed to operate in a multi-asset, dynamic market. Portfolio analysis simulates real-world conditions, helping you understand how your algorithm performs when managing a range of assets simultaneously.

- Risk Management: Successful trading is not just about maximizing returns but also about minimizing risk. Portfolio analysis allows you to gauge the algorithm’s ability to balance risk and return, helping you fine-tune risk management strategies.

- Diversification Impact: A well-structured portfolio reduces reliance on a single asset, spreading risk. Portfolio analysis shows how your algorithm handles asset correlations, diversification, and its impact on overall portfolio stability.

- Robustness Testing: By subjecting your algorithm to various market conditions, portfolio analysis reveals its robustness. Can it adapt to different market trends, volatility levels, or economic events?

- Performance Metrics: Portfolio analysis provides a comprehensive view of performance metrics like returns, volatility, drawdowns, and the Sharpe ratio. These metrics offer insights into the algorithm’s profitability and risk-adjusted returns.

- Optimization Insights: Through portfolio analysis, you can identify asset allocation strategies that maximize returns while managing risk. It helps you optimize your trading algorithm for better outcomes.

- Continuous Improvement: Trading algorithms should be dynamic and adaptable. Portfolio analysis guides ongoing refinement, ensuring your algorithm remains effective in evolving market conditions.

In summary, portfolio analysis is the linchpin of trading algorithm testing. It evaluates your algorithm’s real-world viability, risk management capabilities, and overall performance within a diversified portfolio context. By focusing on this crucial step, you can enhance your algorithm’s chances of success in the ever-changing financial markets.

20 years 99.9% Tick Data tests of the Powerful Price Action EA.

EURUSD H4 Chart – 20 years every tick data test

EURUSD H4 detailed statistics – 20 years every tick data test

NZDUSD H4 detailed statistics – 20 years every tick data test

AUDUSD H4 detailed statistics – 20 years every tick data test

Check out the detailed explanation of the EA and all its parameters:

///As investment robot trading also has risks so, the Past performance is not indicative of future performance. No representation is being made that any results discussed within the service and its related media content will be achieved. Use them at your own risk.////