Introduction

Day trading in the forex market can be a rewarding yet challenging endeavor, demanding keen attention to market dynamics and prudent risk management strategies. One of the most effective tools for day traders is the Average True Range (ATR), which measures market volatility and helps in setting appropriate stop-loss levels and determining trade sizes. By leveraging the ATR multiplier, traders can fine-tune their strategies to align with current market conditions, thereby enhancing their trading outcomes.

Understanding ATR and Its Significance

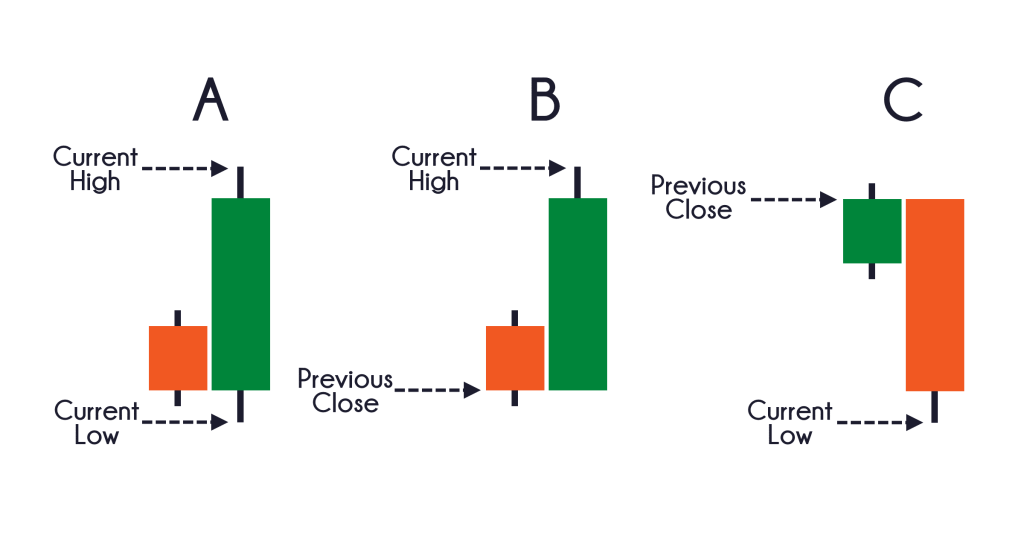

The ATR, developed by J. Welles Wilder, is a measure of volatility that considers the range of price movements over a specified period, typically 14 days. It provides a quantitative basis for understanding how much the price of a currency pair typically moves.

For day traders, ATR is particularly valuable because it:

- Quantifies Volatility: Helps in understanding the current market conditions.

- Aids in Risk Management: Assists in setting stop-loss levels that are neither too tight (leading to frequent stops) nor too wide (resulting in significant losses).

ATR Multiplier: An Essential Tool for Day Traders

The ATR multiplier is used to adjust the ATR value to set stop-loss levels and determine position sizes. Here’s how different ATR multipliers can be effectively utilized in day trading forex pairs:

1. 1.5x to 2x ATR: Conservative Approach

Using a multiplier of 1.5 to 2 times the ATR is a conservative strategy. This is beneficial in quieter market conditions or for traders who prefer tighter risk controls. While this approach can limit potential losses, it might also lead to more frequent stop-outs during volatile periods.

2. 2x to 2.5x ATR: Balanced Approach

A multiplier of 2 to 2.5 times the ATR is considered balanced. It strikes a good middle ground, providing enough room for the natural fluctuations of the market without getting stopped out too often. This approach suits average market conditions and offers a good blend of risk and reward.

3. 2.5x to 3x ATR: Aggressive Approach

An aggressive strategy involves using a 2.5 to 3 times ATR multiplier. This is useful during periods of high volatility or when anticipating significant price movements. While it accommodates larger market swings, it also increases potential risks, making it essential for traders to have a solid risk management plan in place.

Practical Application of ATR Multiplier

Setting Stop-Loss Levels

Assume the current ATR for a forex pair is 0.0010 (10 pips). Using different multipliers, the stop-loss levels can be calculated as follows:

- 1.5x ATR: 10 pips * 1.5 = 15 pips

- 2x ATR: 10 pips * 2 = 20 pips

- 2.5x ATR: 10 pips * 2.5 = 25 pips

Determining Position Size

Position sizing is crucial to ensure that your total dollar risk stays within your predefined risk tolerance. For example, if you are willing to risk $100 per trade and use a 2x ATR multiplier (20 pips stop-loss), your position size should be adjusted so that a 20 pips move equals a $100 loss.

Calculation example:

- Determine ATR: ATR is 10 pips.

- Select Multiplier: Choose 2x.

- Calculate Stop-Loss: 10 pips * 2 = 20 pips stop-loss.

- Risk Management: If risking $100 per trade, and 20 pips represent $100, then each pip is worth $5. Therefore, you can trade 0.5 standard lots (assuming 1 pip in a standard lot is worth $10).

Conclusion

Selecting the right ATR multiplier is essential for optimizing your day trading strategy in forex. By experimenting with different multipliers and backtesting your approach, you can find the optimal balance between risk and reward that suits your trading style and market conditions. Always remember that effective risk management is the cornerstone of successful trading.

For those looking to automate their trading strategies, consider exploring safe, tick data tested trading robots available on my website. These robots are designed to enhance trading efficiency and accuracy, making them valuable tools for both novice and experienced traders.

Happy trading!

Hozzászólás