In the dynamic world of forex trading, success often hinges on the ability to decipher market sentiment accurately. Traders employ various technical indicators to gain insights into market trends and potential price movements. One such indicator that has earned its stripes in the realm of forex analysis is the Money Flow Index (MFI). In this article, we delve into the intricacies of the MFI and explore why it stands out as a powerful tool for traders.

Understanding the Money Flow Index (MFI)

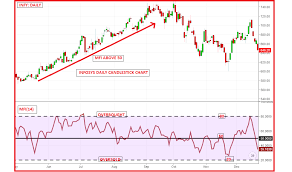

The Money Flow Index, developed by Gene Quong and Avrum Soudack, is a momentum oscillator that measures the strength of money flowing in and out of a financial asset. It combines both price and volume data to assess buying and selling pressure in the market. The MFI oscillates between 0 and 100, with readings above 80 typically signaling overbought conditions and readings below 20 indicating oversold conditions.

Key Advantages of Using MFI in Forex Trading

1. Identifying Overbought and Oversold Conditions

One of the primary advantages of MFI is its ability to identify overbought and oversold conditions in the forex market. Traders can use MFI readings to pinpoint potential reversal points, helping them anticipate shifts in market sentiment and adjust their trading strategies accordingly.

2. Incorporating Volume Analysis

Unlike many other technical indicators that rely solely on price data, MFI incorporates volume analysis, providing traders with a more comprehensive view of market dynamics. By considering both price movements and trading volumes, MFI offers valuable insights into the strength of buying and selling pressure behind price movements.

3. Divergence Signals

MFI can also be a potent tool for detecting divergence between price and momentum. Divergence occurs when the price of a currency pair moves in one direction, but the MFI moves in the opposite direction. This discrepancy can foreshadow potential trend reversals, alerting traders to favorable trading opportunities.

4. Confirmation Tool

In addition to its standalone capabilities, MFI serves as an effective confirmation tool when used in conjunction with other technical indicators or chart patterns. Traders often look for confluence between MFI readings and other signals to bolster their confidence in trade setups and validate their trading decisions.

5. User-Friendly and Versatile

One of the standout features of MFI is its simplicity and ease of use. Traders of all experience levels can quickly grasp its concepts and incorporate it into their trading strategies. Whether employed as a standalone indicator or as part of a broader analysis toolkit, MFI offers versatility and adaptability to suit diverse trading styles and preferences.

Conclusion

The Money Flow Index (MFI) occupies a prominent position among the arsenal of technical tools available to forex traders. Its ability to gauge market momentum, identify overbought and oversold conditions, and detect divergence signals makes it a valuable asset in navigating the complexities of the forex market. By leveraging the insights provided by MFI, traders can make informed decisions, manage risk effectively, and strive for success in their trading endeavors.

Hozzászólás