The Illusion of Legitimacy:

Unregulated forex brokers operate in the shadows, evading the watchful eye of regulatory authorities by exploiting legal loopholes and operating in jurisdictions with lax oversight. Despite lacking the necessary licenses and regulatory scrutiny, these brokers often present a façade of legitimacy, complete with flashy websites, impressive trading platforms, and enticing promotional offers. However, beneath the surface lies a web of deceit and manipulation, designed to lure unsuspecting traders into their trap.

False Promises and Unrealistic Expectations:

One of the hallmarks of unregulated forex brokers is their propensity to make extravagant claims and promises. From guaranteed profits to secret trading strategies, these brokers employ a variety of tactics to create the illusion of easy money. Through aggressive marketing campaigns and persuasive sales tactics, they prey on the vulnerabilities and aspirations of novice traders, enticing them with visions of financial freedom and success.

Manipulated Trading Conditions:

Once enticed into opening an account, traders soon discover the harsh reality of trading with unregulated brokers. Behind the sleek interface of their trading platforms lies a rigged game, where the odds are stacked against the trader from the outset. Unregulated brokers often manipulate trading conditions, including spreads, slippage, and execution speeds, to ensure that the house always wins. Trades mysteriously fail to execute at the desired price, stop-loss orders are triggered prematurely, and profits evaporate into thin air, leaving traders baffled and frustrated.

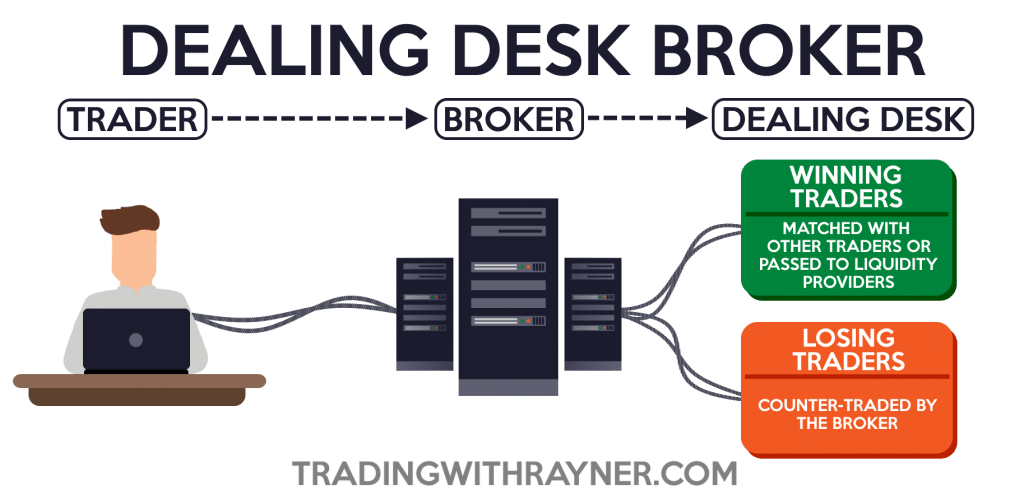

The Phantom Brokerage Model:

Another common tactic employed by unregulated forex brokers is the use of the phantom brokerage model. Under this scheme, brokers act as market makers, taking the opposite side of their clients’ trades and profiting from their losses. By manipulating prices and order flows, these brokers ensure that the vast majority of their clients end up losing money, while they pocket hefty profits in the process. In essence, traders are not competing against the market, but rather against the broker itself, making success an elusive and unattainable goal.

The Devastating Human Cost:

Behind the numbers and statistics lies the devastating human cost of unregulated forex brokers’ scams. Countless traders, lured by the promise of easy money, have seen their life savings wiped out in a matter of days, their dreams shattered, and their trust betrayed. The emotional toll of financial ruin is immeasurable, leading to stress, anxiety, and depression for those who fall victim to these predatory practices.

The Call for Regulation and Accountability:

As the scourge of unregulated forex brokers continues to proliferate, calls for stricter regulation and oversight have grown louder. Advocates argue that only through robust regulatory frameworks and enforcement mechanisms can the industry be cleansed of bad actors and restored to its former integrity. By holding unscrupulous brokers accountable for their actions and protecting traders from exploitation, regulators can ensure that the forex market remains a fair and transparent playing field for all participants.

In conclusion, the rise of unregulated forex brokers represents a grave threat to the integrity and credibility of the forex industry. Through deception, manipulation, and outright fraud, these brokers systematically prey on unsuspecting traders, leaving a trail of devastation and despair in their wake. Only through concerted efforts by regulators, law enforcement agencies, and industry stakeholders can the scourge of unregulated forex brokers be eradicated, and the trust and confidence of traders restored.

Hozzászólás